Kentucky Sales And Use Tax Permit Application . To register for a kentucky sales tax permit, you can apply at the department of commerce’s online kentucky business one stop portal, or with form 10a100, the kentucky. Learn how to register for the most common tax types for kentucky businesses, including sales and use tax, online through the kentucky. 1.) where do i get an application (form 10a100) for a sales tax account? This post offers information on how to register for a sales tax permit in kentucky. The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the.

from www.formsbank.com

1.) where do i get an application (form 10a100) for a sales tax account? To register for a kentucky sales tax permit, you can apply at the department of commerce’s online kentucky business one stop portal, or with form 10a100, the kentucky. This post offers information on how to register for a sales tax permit in kentucky. The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. Learn how to register for the most common tax types for kentucky businesses, including sales and use tax, online through the kentucky.

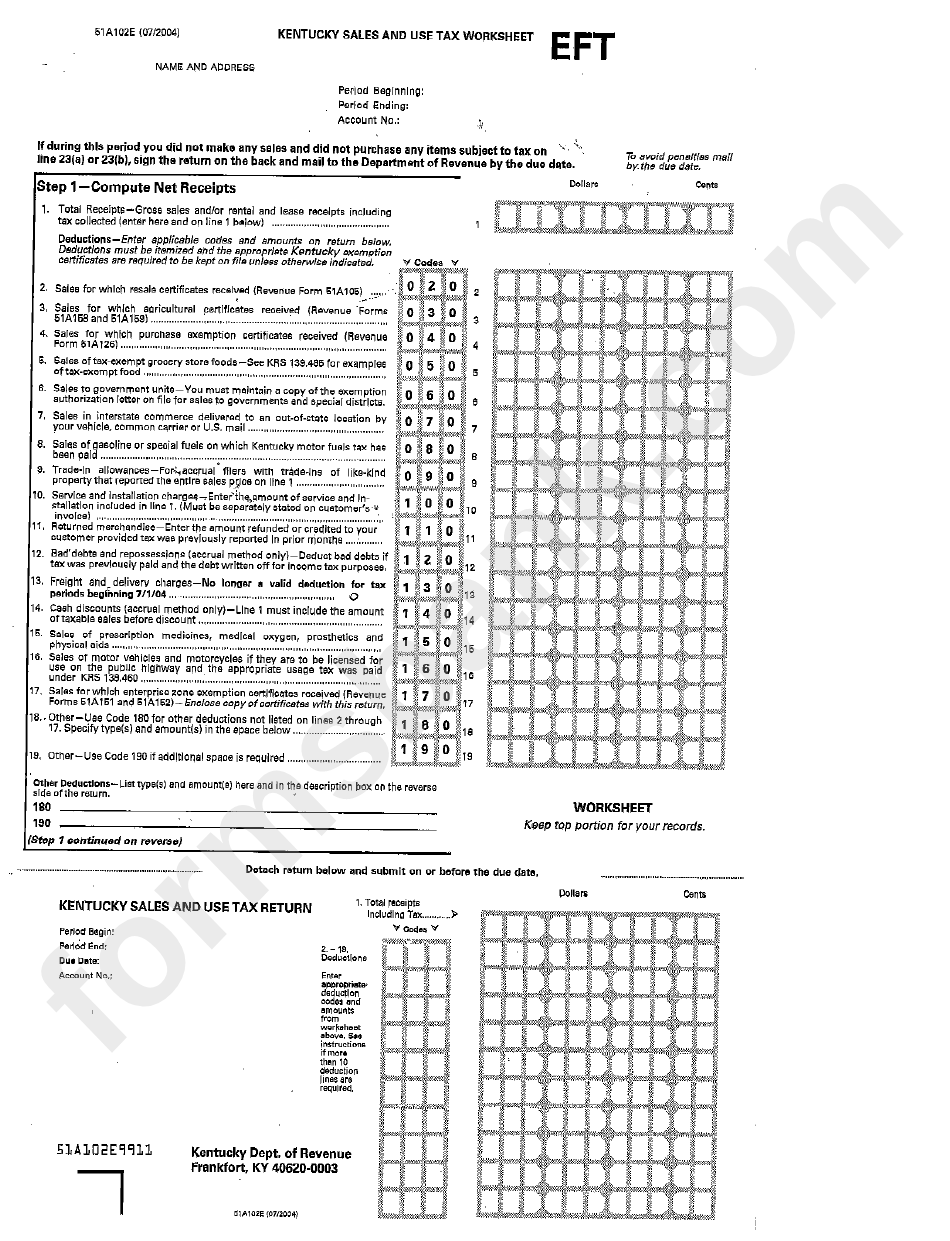

Form 51a102e Kentucky Sales And Use Tax Worksheet Kentucky

Kentucky Sales And Use Tax Permit Application 1.) where do i get an application (form 10a100) for a sales tax account? To register for a kentucky sales tax permit, you can apply at the department of commerce’s online kentucky business one stop portal, or with form 10a100, the kentucky. This post offers information on how to register for a sales tax permit in kentucky. The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. 1.) where do i get an application (form 10a100) for a sales tax account? Learn how to register for the most common tax types for kentucky businesses, including sales and use tax, online through the kentucky. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the.

From www.dochub.com

Kentucky resale certificate Fill out & sign online DocHub Kentucky Sales And Use Tax Permit Application To register for a kentucky sales tax permit, you can apply at the department of commerce’s online kentucky business one stop portal, or with form 10a100, the kentucky. The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. 1.) where do i get an application (form 10a100) for a. Kentucky Sales And Use Tax Permit Application.

From webinarcare.com

How to Get Kentucky Sales Tax Permit A Comprehensive Guide Kentucky Sales And Use Tax Permit Application The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. To register for a kentucky sales tax permit, you can apply at the department of commerce’s online kentucky business one stop portal, or with form 10a100, the kentucky. Learn how to register for the most common tax types for. Kentucky Sales And Use Tax Permit Application.

From www.exemptform.com

In Fill In Sales Tax Exempt Form Kentucky Sales And Use Tax Permit Application 1.) where do i get an application (form 10a100) for a sales tax account? This post offers information on how to register for a sales tax permit in kentucky. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. The division of sales and use tax. Kentucky Sales And Use Tax Permit Application.

From www.aaaanime.com

Retail Sales Tax Permit 1 or Retail Sales Tax Permit 2 Click Here Kentucky Sales And Use Tax Permit Application The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. Learn how to register for the most common tax types for kentucky businesses, including sales and use tax, online through the kentucky. 1.) where do i get an application (form 10a100) for a sales tax account? To register for. Kentucky Sales And Use Tax Permit Application.

From www.dochub.com

Form ap 201 Fill out & sign online DocHub Kentucky Sales And Use Tax Permit Application To register for a kentucky sales tax permit, you can apply at the department of commerce’s online kentucky business one stop portal, or with form 10a100, the kentucky. Learn how to register for the most common tax types for kentucky businesses, including sales and use tax, online through the kentucky. The division of sales and use tax manages collection and. Kentucky Sales And Use Tax Permit Application.

From www.golddealer.com

Kentucky State Tax Kentucky Sales And Use Tax Permit Application The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. Learn how to register for the most common tax types for kentucky businesses, including sales and use tax, online through the kentucky. To register for a kentucky sales tax permit, you can apply at the department of commerce’s online. Kentucky Sales And Use Tax Permit Application.

From www.formsbank.com

Form 10a100 Kentucky Tax Registration Application printable pdf download Kentucky Sales And Use Tax Permit Application Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. To register for a kentucky sales tax permit, you can apply at the department of commerce’s online kentucky business one stop portal, or with form 10a100, the kentucky. Learn how to register for the most common. Kentucky Sales And Use Tax Permit Application.

From www.pdffiller.com

Kentucky Sales And Use Tax Worksheet 51a102 Fill Online, Printable Kentucky Sales And Use Tax Permit Application Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. Learn how to register for the most common tax types for kentucky businesses, including sales. Kentucky Sales And Use Tax Permit Application.

From db-excel.com

Collection Of Kentucky Sales And Use Tax Worksheet — Kentucky Sales And Use Tax Permit Application Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. This post offers information on how to register for a sales tax permit in kentucky. To register for a kentucky sales tax permit, you can apply at the department of commerce’s online kentucky business one stop. Kentucky Sales And Use Tax Permit Application.

From www.dochub.com

Kentucky tax exempt form Fill out & sign online DocHub Kentucky Sales And Use Tax Permit Application To register for a kentucky sales tax permit, you can apply at the department of commerce’s online kentucky business one stop portal, or with form 10a100, the kentucky. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. The division of sales and use tax manages. Kentucky Sales And Use Tax Permit Application.

From www.formsbank.com

Form 51a102e Kentucky Sales And Use Tax Worksheet Kentucky Kentucky Sales And Use Tax Permit Application The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. 1.) where do i get an application (form 10a100) for a sales tax account? This. Kentucky Sales And Use Tax Permit Application.

From www.formsbank.com

Form 10a100 Kentucky Tax Registration Application For Withholding Kentucky Sales And Use Tax Permit Application The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. To register for a kentucky sales tax permit, you can apply at the department of commerce’s online kentucky business one stop portal, or with form 10a100, the kentucky. This post offers information on how to register for a sales. Kentucky Sales And Use Tax Permit Application.

From www.formsbank.com

Form 51a205 Kentucky Sales And Use Tax Instructions Commonwealth Of Kentucky Sales And Use Tax Permit Application 1.) where do i get an application (form 10a100) for a sales tax account? This post offers information on how to register for a sales tax permit in kentucky. The division of sales and use tax manages collection and administration of sales and use taxes for the department of revenue. Kentucky allows you to apply for a sales tax permit,. Kentucky Sales And Use Tax Permit Application.

From www.formsbank.com

Top 44 Kentucky Sales Tax Form Templates free to download in PDF format Kentucky Sales And Use Tax Permit Application Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the. 1.) where do i get an application (form 10a100) for a sales tax account? This post offers information on how to register for a sales tax permit in kentucky. Learn how to register for the most. Kentucky Sales And Use Tax Permit Application.

From www.slideserve.com

PPT Kentucky Sales and Use Tax PowerPoint Presentation, free download Kentucky Sales And Use Tax Permit Application 1.) where do i get an application (form 10a100) for a sales tax account? Learn how to register for the most common tax types for kentucky businesses, including sales and use tax, online through the kentucky. Kentucky allows you to apply for a sales tax permit, along with all other relevant tax ids and permits, by submitting form 10a100 (the.. Kentucky Sales And Use Tax Permit Application.

From www.formsbank.com

Form 10a100 Kentucky Tax Registration Application For Withholding Kentucky Sales And Use Tax Permit Application Learn how to register for the most common tax types for kentucky businesses, including sales and use tax, online through the kentucky. To register for a kentucky sales tax permit, you can apply at the department of commerce’s online kentucky business one stop portal, or with form 10a100, the kentucky. The division of sales and use tax manages collection and. Kentucky Sales And Use Tax Permit Application.

From www.signnow.com

Kentucky Exemption Sales Tax PDF 20172024 Form Fill Out and Sign Kentucky Sales And Use Tax Permit Application 1.) where do i get an application (form 10a100) for a sales tax account? This post offers information on how to register for a sales tax permit in kentucky. To register for a kentucky sales tax permit, you can apply at the department of commerce’s online kentucky business one stop portal, or with form 10a100, the kentucky. Learn how to. Kentucky Sales And Use Tax Permit Application.

From db-excel.com

Kentucky Sales And Use Tax Form 2019 Return 51A102 51A205 — Kentucky Sales And Use Tax Permit Application This post offers information on how to register for a sales tax permit in kentucky. To register for a kentucky sales tax permit, you can apply at the department of commerce’s online kentucky business one stop portal, or with form 10a100, the kentucky. The division of sales and use tax manages collection and administration of sales and use taxes for. Kentucky Sales And Use Tax Permit Application.